Assigning Tax Line Items To Categories In Quicken For Mac

If you're Mac user who is new to personal finance software, Quicken Essentials may just be enough for you. But, if you switch to another software later on, you may not be able to get your data to import into other software and you would have to enter transactions all over again (however, iBank 4 imports Quicken Essentials for Mac data). If you just need very basic personal finance software and doubt you'll have a need more money management features in the future, Quicken Essentials is worth a look. Quicken Essentials was very responsive, screens opened when called and data updated quickly. Everything in the software is bright and colorful, from the overview screen to spending category selection in the budget. This aspect of the software makes it really enjoyable to use. Pie charts and bar graphs are used to convey information at a glance.

Click on these graphics to drill down and see the transactions or accounts that make up the graph. The visuals are nicely done and never pokey, with boxes that flip open with options to be chosen. Speaking of adding accounts, the three credit cards I set up are all at one financial institution and Quicken Essentials recognized this so transactions for all cards were downloaded at once. I usually have to establish each of these accounts separately in the personal finance software. Account balances are found by clicking on Account Summary in the left toolbar, and account registers are accessed by clicking on the accounts listed in the same toolbar. To find a list of payees, categories, and tags, click on Window on the top toolbar. Quicken Essentials comes with six reports which are listed on the left toolbar, with very basic customization options.

Assigning Tax Line Items To Categories In Quicken For Mac

If you used Quicken for Windows or are a financial report hound, you're not going to be happy. Options included the ability to select accounts, categories, and tags to include in the reports and the date range can be changed. There is no budget report that shows month to month budgeted amounts compared to actual spending, you will only find a bar graph available in the budget module. Setting up the budget is easy in Quicken Essentials for Mac.

When you first open the budget feature, spending goals per expense category are recommended based on a three-month average of your downloaded transactions. You can change the goal amounts and add goals for that the automatic doesn't pick up, or remove categories you don't want to track.

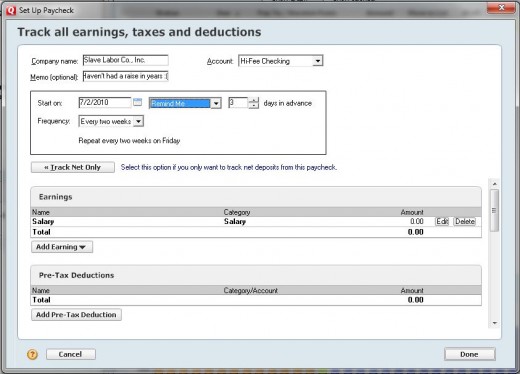

That's about all there is to budgeting in Quicken Essentials. As noted above, there is no comprehensive budget reporting. If keeping a more detailed budget is important to you, try, or MoneyWell. If you track tax-related budget categories, you can export data for use in any tax software that supports the, and most if not all do. To export data to tax software, categories are assigned to tax line items found on IRS tax schedules and forms used for your tax return.

It is critical that these assignments are made properly. At the end of the year, click on Tax Schedule found in the toolbar under Reports, then select Export Taxes.

This produces a TXF data file, which is then imported into tax software (the tax interview will ask you for it). The great thing about this personal finance software is that it has speedy downloads from a huge selection of financial institutions, and it actually looks and behaves like a Mac application, unlike earlier versions. Unfortunately, Quicken Essentials for Mac also lacks some of the features users counted on in earlier Quicken Mac versions, but Intuit is still supporting Quicken Mac 2007. If you need the, investment and other features in Quicken Mac, you should probably keep using it and wait for Quicken Essentials features to expand before you switch.

. You can customize the Category List by creating categories of your own and deleting or hiding categories that you don't need.You can customize the Category List by creating categories of your own and deleting or hiding categories that you don't need.

If you plan to use your Quicken data when filing your income tax forms or when creating tax schedule or capital gains reports, set up tax-related categories so that Quicken can associate the correct data with the correct tax form. Specialized investment categories, which begin with an underscore (such as DivInc), appear in the Category List as soon as you add an investment account. Subcategories add detail within a category. For example, you can create subcategories under the Recreation category to track your spending on specific activities. Your reports show the subcategory amounts as subtotals for their parent category. You can nest subcategories up to 16 levels deep. However, may be a better solution.

Choose Tools menu Category List. Click Add Category. Enter a name for the new category. Indicate whether the category is for tracking income or expenses. To change the category to a subcategory, select Subcategory of and enter the name of the parent category. Enter a description for the new category. (Optional) 7.

Assign a category group to the new category. This field appears only if one or more category groups exist. (Optional) Category Group - A group of categories used for budgeting purposes. For example, you can assign the categories Movies and Books to the category group Discretionary and assign a budget amount to track your discretionary expenses. In previous versions of Quicken, Category Groups were referred to as Supercategories.

If the category is for tracking tax-related transactions, click the Tax Reporting tab and then select the Tax-related check box. Indicate if you want to use the Standard or Extended line item list.

In the Tax line item field, select the tax form and tax schedule line item you want to use. (Optional). Monitoring alerts, data downloads, and feature updates are available through the end of your membership term. Online services require internet access. Third-party terms and additional fees may apply.

Phone support, online features, and other services vary and are subject to change. 14,500+ participating financial institutions as of October 1, 2018. Standard message and data rates may apply for sync, e-mail and text alerts. Visit for details.

Quicken App is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Not all Quicken desktop features are available in the App. The App is a companion app and will work only with Quicken 2015 and above desktop products. Quicken Bill Pay (Bill Payment Services provided by Metavante Payment Services, LLC) is included in Quicken Premier and above and is available on as a separate add-on service in Starter and Deluxe.

Assigning Tax Line Items To Categories In Quicken For Mac 2017

15 payments per month included in Premier and above. Purchase entitles you to Quicken for 1 or 2 years (depending upon length of membership purchased), starting at purchase. Full payment is charged to your card immediately. At the end of the membership period, membership will automatically renew every year and you will be charged the then-current price (prices subject to change). You may cancel before renewal date. For full details, consult the Quicken Membership Agreement.

You can manage your subscription at your My Account page. Quicken 2019 for Windows imports data from Quicken for Windows 2010 or newer, Microsoft Money 2008 and 2009 (for Deluxe and higher). Quicken 2019 for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. 30-day money back guarantee: If you’re not satisfied, return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less shipping and handling fees. See for full details and instructions. Quicken for Mac software and the Quicken App are not designed to function outside the U.S.

The VantageScore provided under the offer described here uses a proprietary credit scoring model designed by VantageScore Solutions, LLC. There are numerous other credit scores and models in the marketplace, including different VantageScores. Please keep in mind third parties may use a different credit score when evaluating your creditworthiness. Also, third parties will take into consideration items other than your credit score or information found in your credit file, such as your income. VantageScore®, Equifax®, Experian® and TransUnion® are registered trademarks of their respective owners.

All 2018 and newer versions of Quicken entitle users to 5GB of free Dropbox storage while subscription is in effect. EQUIFAX is a registered trademark of Equifax Inc. The other Equifax marks used herein are trademarks of Equifax Inc.

Other product and company names mentioned herein are property of their respective owners. Portfolio tracking included with Quicken Premier and Quicken Home & Business on Windows. Payment links are only available for Quicken Premier and Home & Business.

Illustrations © Adam Simpson. All rights reserved.

© 2018 Quicken Inc. All rights reserved.

Quicken is a registered trademark of Intuit Inc., used under license. © 2018 Quicken Inc. All rights reserved. Quicken is a registered trademark of Intuit Inc., used under license. IPhone, iPod, iPad Touch are trademarks of Apple Inc., registered in the U.S. And other countries.

Android is a trademark of Google Inc. Dropbox, PayPal, Yelp, and other parties’ marks are trademarks of their respective companies. Terms, conditions, features, availability, pricing, fees, service and support options subject change without notice. Corporate Headquarters: 3760 Haven Avenue, Menlo Park, CA 94025.